[vc_row][vc_column][ts_section_title animate_block=”yes” animation_type=”fadeInUp” title=”Alcohol Products”][vc_column_text css_animation=”fadeInLeft”][/vc_column_text][vc_column_text css_animation=”fadeInRight”]

[/vc_column_text][vc_column_text css_animation=”fadeInLeft”]

[/vc_column_text][vc_column_text css_animation=”fadeInLeft”]

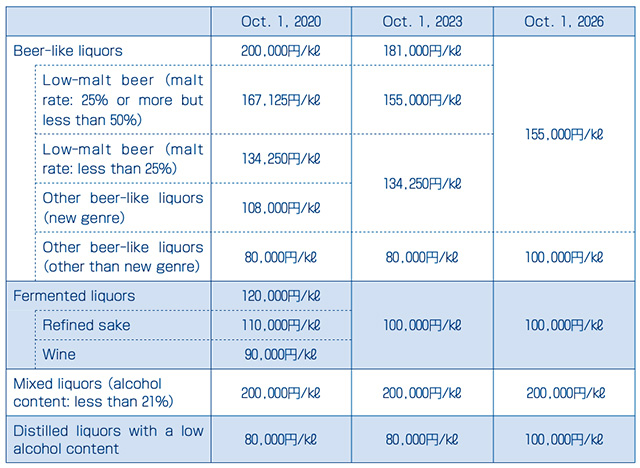

Tax rates are to be revised in stages

Through the FY2017 Tax Reform, the structure of tax rates for liquors was significantly revised from the perspective of restoring tax burden fairness between. different types of liquors. Tax rate revision is to be enforced on October 1, 2020, but a sufficient transitional period up to October 1, 2026, is set and the revision is to be implemented in stages. For example, the basic tax rate for fermented liquors is uniformly set at 100.000 yen/kl with the aim of eliminating the tax rate difference between wine and refined sake. Therefore, the tax rate for wine, which is currently 80.000 yen/kl, is to be raised in stages.

(Source) Ministry of Finance’s Website. “FY 2017 Tax Reform (Main Points) -Liquor Tax Reform”[/vc_column_text][/vc_column][/vc_row][vc_row equal_height=”yes” css_animation=”none” css=”.vc_custom_1646961965902{margin-top: -80px !important;margin-bottom: -80px !important;}”][vc_column css_animation=”none” width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”501″ title=”Food Sanitation” url=”/help-desk/food-sanitation-act/”][/vc_column][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1014″ title=”Plant Products” url=”/help-desk/plant-products/” animation_delay=”0.2s”][/vc_column][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1015″ title=”Animal Products” url=”/help-desk/animal-products/” animation_delay=”0.4s”][/vc_column][/vc_row][vc_row equal_height=”yes” css_animation=”none” css=”.vc_custom_1646961973616{margin-top: -80px !important;margin-bottom: -80px !important;}”][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1020″ title=”Aquatic Products” url=”/help-desk/aquatic-products/” animation_delay=”0.6s”][/vc_column][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1021″ title=”Alcohol Products” url=”/help-desk/alcohol-products/” animation_delay=”0.8s”][/vc_column][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1024″ title=”Custom Clearance” url=”/help-desk/custom-clearance/” animation_delay=”1.0s”][/vc_column][/vc_row][vc_row equal_height=”yes” css_animation=”none” css=”.vc_custom_1646961982528{margin-top: -80px !important;margin-bottom: -80px !important;}”][vc_column width=”1/3″][ts_image_content_box animate_block=”yes” animation_type=”bounceInUp” image=”1023″ title=”Food Labeling” url=”/help-desk/food-labeling/” animation_delay=”1.2s”][/vc_column][vc_column width=”1/3″][/vc_column][vc_column width=”1/3″][/vc_column][/vc_row]